Inventory, raw materials, delivery charges and hourly labor are examples of variable costs. The more products a business sells, the more money it spends on materials and manpower to produce those products. Cost is divided into direct and indirect cost in terms of degree of traceability to cost object i.e. product or job. The performance of a manager is indicated by the controllable profit and the success of the division as a whole is judged on the traceable profit. As mentioned earlier one of the key characteristics of effective divisional performance measures it that they encourage goal congruence.

- His career includes public company auditing and work with the campus recruiting team for his alma mater.

- These costs cannot be avoided and so must be paid even when there is no revenue coming in.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

- Cost tracing and analysis can be conducted using a multitude of methods and assumptions.

- However, small businesses face scarcities in resources due to different limitations—such as financial capabilities, difficulty in accessing materials, and other external factors.

What are Traceable and Common Fixed Costs? ( Definition and Explaination)

Cost traceability analysis can also help suppliers to align their goals and incentives with the business process or the product and create a win-win situation. This can help the supplier to improve the quality and functionality of the feature, to negotiate the price and contract terms with the software company, and to establish a long-term relationship with the software company. Direct costs are traceable to a specific product or business component, while indirect costs benefit multiple products or the business in general. Knowing the difference between direct vs indirect costs helps in understanding the business’s cost structure and developing a competitive pricing strategy. Moreover, understanding the nature of costs enables you to determine if all costs are accounted for correctly and if the net income reflects the business’s true performance for a particular period. Traceable fixed costs, the meaning of this type of cost, and the distinction between traceable and common fixed costs are relevant in segmented financial reporting.

What is Cost Tracing – Meaning and Purpose of Cost Tracing

Moreover, provided the new product is successful we could expect it to continue to generate additional revenues in subsequent years. The company’s marketing department spent $14 million on a major marketing campaign (on behalf of Division traceable cost B) to accompany the product launch. Document verification is a process of verifying the identity and authenticity of a person or an… In the realm of data-driven decision-making, the precision of the output is only as good as the…

What are the benefits of ABC in the manufacturing and service industries?

In the past, we believe that the fixed costs remain the same regardless of the business operation. However, now we can separate the fixed cost by different cost objects such as segment, location, and so on. When looking at cost tracing and allocation, company owners need to determine how closely to allocate individual costs. With modern computer systems, it is often possible to track every cost down to the gram of glue or individual screw. However, the cost involved with this level of tracking often outweighs the benefit.

Why Do Direct vs Indirect Costs Matter?

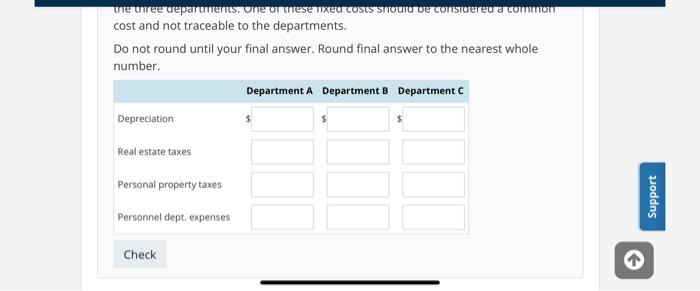

Whether depreciation should be charged as a traceable fixed cost or a common fixed cost depends on the usage of the machinery. For example, certain fixed costs are specific to certain functions or certain lines of operations within a business. It becomes imperative to consider these costs to get a fair idea of the profitability of a certain segment. Common Fixed cost is the fixed cost that supports the business activities of the two or more business segments. It is the cost that is paid in total to cover all cost objectives in different business units, locations,s and so on.

Identifying Factors that Influence Cost Variations

Read our article about managerial accounting and its importance for small businesses. Our guide will show you the different managerial accounting tools and how to apply them for small businesses. And an opportunity to boost margins by 8%-10% enterprise-wide with a mix of pricing change across customers and channels. For example, a company might have numerous different divisions under which they are meant to serve numerous different areas.

For instance, if a business did not have a research-and-development division, the business would not have a research-and-development division manager to whom it had to pay a salary. If the research-and-development division never existed, the cost of the division manager’s salary would have never existed. Furthermore, if the research-and-development division ceased to exist, the cost of the division manager’s salary would no longer exist. Therefore the cost of the manager’s salary is specifically traceable to the research-and-development division.

By analyzing cost drivers and understanding their influence, businesses can make informed decisions to optimize costs and improve profitability. Mapping cost flows is a valuable practice for organizations seeking to gain a comprehensive understanding of their cost structure. By tracing the journey of costs within the organization, organizations can identify inefficiencies, optimize resource allocation, and make informed decisions to improve financial performance.