Each purchase invoice is recorded as a line item in the purchases journal as shown in the example below. In this example, all the items are assumed to be inventory purchases and some information has been omitted to simplify the example. Any investor who wants to look at cash purchases should instead look to the cash flow statement. It further differentiates among cash purchases for financing activities, investing activities, and operating activities. For even more-detailed entries, https://www.bookstime.com/articles/statement-of-comprehensive-income cash payments are listed in the general ledger, which credits the cash account and debits the corresponding payable.

Do you own a business?

For example, credit purchases should be an increase in credit as it is the liabilities. If those purchases are for inventories, then inventories accounts should be debited. The main information in the purchase journal includes the name of the entity, accounting period, date, suppliers’ accounts, invoices date, and payment terms. If there is a small number of transactions of credit purchases, then the entity might record the purchase journal together with other transactions. You must be able to substantiate certain elements of expenses to deduct them on your tax return.

Which of these is most important for your financial advisor to have?

A purchase book is a special-purpose subsidiary book prepared by a business to record all credit purchases. Nowadays all these recordings occur in ERPs and only small firms resort solely to notebooks or MS Excel. In some cases, an expense may come from several internal accounts because multiple products or services are on a single invoice.

Recording Periods of Purchases Journals

Purchase journal is the special journal that uses to records all of the transactions related to purchases on credit. You should update your purchases journal as often as necessary to reflect the most current information. This may be daily, weekly, or monthly, depending on the type of business you run and the products and services you offer. The balance in this list is compared with the balance in the general ledger accounts payable account.

Purchase of Furniture increases the value of an asset and according to the Rules of Debit and Credit, an increase in an asset A/c is debited . The actual format or look of the invoice issued by a seller to his buyer may be slightly different from the above specimen but basic information provided therein is almost similar. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. Since Purchase of goods is an expense, so, Purchases A/c would be debited, because according to the Rules of Debit and Credit, an expense A/c is debited .

Purchases Journal Used to Update the Accounts Payable Ledger

A purchases journal is a specialized type of accounting log that keeps track of orders made by a business on credit or on account. And all you need to enter are the date, name of suppliers, supplies accounts, invoices identification, description of transactions, and amounts. This special journal is prepared for reducing the large of transactions in purchases journal the general journals. And it is normally prepared only if the entity has a lot of purchases on credit transactions. A purchases journal is a special journal used to record any merchandise purchased on account.

- If a person were researching the details of a purchase, it would be necessary to go back to the purchases journal to locate a reference to the source document.

- The Times maintains several regional bureaus staffed with journalists across six continents, and has received 137 Pulitzer Prizes as of 2023, the most of any publication, among other accolades.

- In the above example, 200 is posted to the ledger account of supplier ABC, 300 to supplier EFG, and 250 to supplier XYZ.

- In some cases, an expense may come from several internal accounts because multiple products or services are on a single invoice.

- All of our content is based on objective analysis, and the opinions are our own.

- Also, the purchase analysis extracted from these journals helps negotiate new contracts.

- You need to note which account funds are taken from to pay for a purchase.

- You may balance accounting journals weekly, biweekly, or monthly, depending on your business needs.

- For example, the debit relating to a purchase of office supplies would be to the supplies expense account.

- For example, credit purchases should be an increase in credit as it is the liabilities.

This summary is ordinarily made in your business books (for example, accounting journals and ledgers). Your books must show your gross income, as well as your deductions and credits. Other names used for the purchases journal are the purchases book, purchases daybook, and the credit purchases journal. Periodically, and no later than the end of each reporting period, the information in the purchases journal is summarized and posted to the general ledger. This means that the purchases stated in the general ledger are only at the most aggregated level.

Understanding the Purchase Day Book: A Comprehensive Guide

The Purchase Day Book, also known as the Purchases Journal, is a vital accounting record used by businesses to systematically record all credit purchases of goods. It serves as a chronological log of transactions related to purchases, providing valuable information for accurate financial reporting and management decision-making. Information such as description of goods or services received, quantity of goods purchased and credit terms are usually on https://www.facebook.com/BooksTimeInc/ the face of invoice but may be recorded in purchases journal as well. You may balance accounting journals weekly, biweekly, or monthly, depending on your business needs.

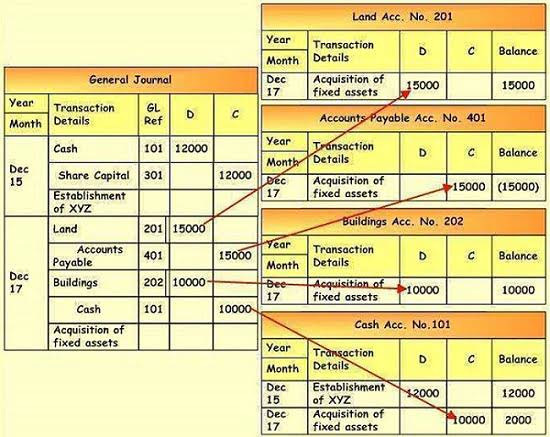

Accounting for Credit And Cash Purchase Transactions (Explained With Journal Entries)

The aggregate of all cash purchases and other cash outflows is instead built into the figures listed in the expenses portion. The first is a debit from an expense account and the second is a payment to the company or service provider. You need to note which account funds are taken from to pay for a purchase. Besides these specific journals, accounting teams also use a general journal. A general journal tracks transactions that do not fall into one of the four categories. An accounting team may use other specialty journals to track certain types of transactions.